This Alert summarizes the key aspects of Malaysias new position on FSI and the recent MOF. You can actually find a complete list of tax exemptions in Schedule 6 of the Income Tax Act 1967 you may have to use CtrlCmd F to find it.

Income Tax Relief Malaysia Madalynngwf

Companies undertaking ASP will be granted partial tax exemption on 70 of the statutory income for 5 yearsThe balance 30 of that statutory income will be taxed at the prevailing company tax rate.

. The following foreign-sourced income which is brought into Malaysia from 1 January 2022 to 31 December 2026 will remain exempt from Malaysian income tax. Malaysian income tax law includes the following exemptions and relief. The tax exemption would allow individual taxpayers to remit their income back to Malaysia tax-free and encourage them to continue to do so.

The Finance Ministry in late December 2021 extended through 31 December 2026 a tax exemption available for foreign-source income for individuals and foreign-source dividend income for corporate taxpayers subject to certain conditions. July 20 2022 Orders on foreign-sourced income have been published in the Malaysian official gazette. Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

However certain types of income specified in Schedule 6 of the ITA such as foreign source income as per paragraph 28 of Schedule 6 are exempt from income tax. Income Exempt from Tax. Travelling allowance petrol allowance toll rate up to RM6000 annually Parking allowance Meal allowance Child care allowance of up to RM2400 annually Subsidies on interest for housing education car loans.

Increased to RM20000 for individuals who ceased employment during the period from 1 January 2020 to 31 December 2021. In Malaysia income tax is charged based on income accruing in derived from or received in the country as stated under Section 3 of the Income Tax Act 1967 ITA. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

6 Order 2022 PU. The Chartered Tax Institute of Malaysia has said that the tax exemption on dividends will encourage more investments to be remitted to Malaysia and improve the countrys standing as a destination for regional HQs. KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the tax initiative said the Ministry of Finance MoF.

Gift of artifacts manuscripts or paintings. - full exemption if due to ill health. Income Tax Exemption No.

Companies undertaking ASP in Sabah Sarawak and the designated eastern corridor of Peninsular Malaysia will be granted partial tax exemption on 85 of the statutory. Just like Benefits-in-Kind Perquisites are taxable from employment income. This applies to an employees immediate family which is defined as their spouse and children.

Here are 5 tax exempted incomes that can easily apply to you. The tax exemption is effective from Jan 1 2022 to Dec 31 2026. Disposal of part of the whole share owned by individual with effect from 31122015 If an individual dispose part of his entire share the exemption allowed is as follows.

Gift of money or contribution in kind for the provision of facilities in public places for the benefit of disabled persons. All categories combined 10 of aggregate income. This relief is applicable for Year Assessment 2013 and 2015 only.

Medical childcare and dental benefits offered to an individual by their employer. While some of these exemptions wont apply to you at all such as being Malaysian Royalty and being a local council. Gift of money for provision of library facilities or to libraries limited to RM20000 RM20000.

The income tax exemption is effective from January 1 2022 until December 31 2026. - RM10000 for every completed year of service with the same employer companies in the same group. On 30 December 2021 the Malaysian Ministry of Finance MOF announced that it will continue to exempt certain categories of foreign-sourced income FSI received by Malaysian tax residents until 31 December 2026 when certain qualifying conditions are met.

Some types of assistance include life insurance medical expenses for parents individual education fees the purchase of a laptop or. Compensation for loss of employment and payments for restrictive covenants. To amend Schedule 6 paragraph 28 of the Income Tax Act 1967 to state that only the income of a non-resident person in Malaysia arising from sources outside Malaysia and received in Malaysia is exempt from tax with effect from 1 January 2022.

The exemption is RM10000 or 10 of the chargeable gain whicever is greater. However there are exemptions. This exemption is particularly beneficial for Malaysians working in Singapore but residing in Malaysia to continue to remit their income back to Malaysia without being subject to additional income tax.

Exemption for foreign-source income is extended COVID-19 January 7 2022. A 2352022 A qualifying person will be exempted from the payment of income tax in respect of the gross income of that qualifying person from dividend income which is received in Malaysia from outside Malaysia in the basis period for a YA.

Updated Guide On Donations And Gifts Tax Deductions

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

What Type Of Income Can Be Exempted From Income Tax In Malaysia

Personal Tax Relief 2021 L Co Accountants

Income Tax Breaks For 2020 The Star

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Malaysia Personal Income Tax Relief 2022

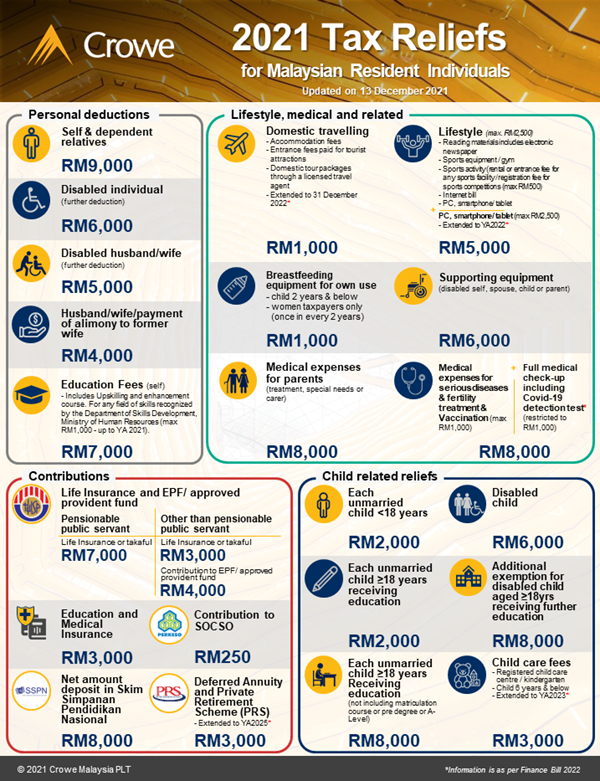

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Malaysia Personal Income Tax 2021 Major Changes Youtube

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Lhdn Irb Personal Income Tax Relief 2020

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Personal Income Tax Guide In Malaysia 2016 Tech Arp

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star